Not only is an increase coming, but a new era is also dawning for wage calculation in all sectors.

In 2024 there will be some changes to Dutch mobility allowances and traffic fines. The tax-free travel allowance for commuting increases from €0,21 to €0,23 per kilometer. This increase is not only relevant for daily commuting, but also extends to other areas such as visiting the sick, travel expenses for disabled people during weekends and holidays, and the donation deduction for volunteers who waive travel reimbursement.

At the same time, the work-from-home allowance will be increased from €2,15 to €2,35, a move that reflects changing working patterns in a post-pandemic world. However, employers can decide for themselves whether to implement this increase.

In addition, a significant increase in traffic fines has been announced, a measure that is probably intended to promote road safety. Fines for common violations such as holding a phone while driving or driving unnecessarily on the left will be significantly increased, by €40 and €30 respectively.

In contrast to these increases, the costs of gasoline and public transport will remain stable in 2024, thanks to government measures. The tax discount on petrol will be continued until 2025 and the previously proposed increase in the costs of public transport has been blocked by the House of Representatives.

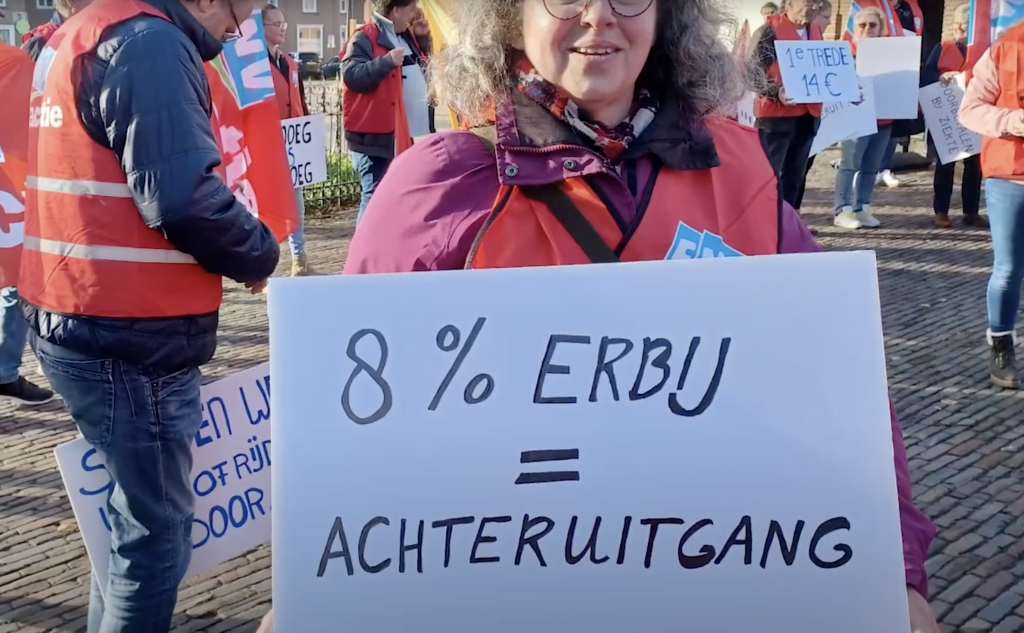

Perhaps the most notable point is the introduction of a uniform minimum hourly wage regardless of the number of hours worked per week, and an increase in the statutory minimum wage to an average of €13,27 for employees aged 21 and over.

This change is an important step towards greater transparency and fairness in the wage structure, making it easier for employees to understand and safeguard their rights.

From January 1, 2024, an important change in the wage structure will be implemented in the Netherlands with the introduction of the statutory minimum hourly wage. This hourly wage replaces the minimum monthly, weekly and daily wages used until then. The new system is simple: a uniform minimum hourly wage applies to all employees aged 21 and over. There are specific minimum youth wages for employees under the age of 21, which are also calculated per hour and are based on the statutory minimum hourly wage.

This change has direct consequences for the wage calculation. The income of employees earning the minimum wage depends on the number of hours worked. This includes not only the hours actually worked, but also hours during which people were on holiday or sick with continued payment of wages.

An interesting aspect of this arrangement is the variability in working hours. The number of working hours may vary monthly, depending on the number of working days in a month. For employees with a fixed working week, it is possible to agree on a fixed monthly salary, based on an average number of working hours per month. This monthly wage is calculated based on the total number of working hours in a year. Such agreements are often laid down in collective labor agreements (CAOs) or in individual employment contracts.