The Chinese taxi company Didi departs from the stock exchange in New York. According to the Financieel Dagblad, the company announced on its social media account on Friday that "after careful investigation, it will immediately start delisting and plan an IPO in Hong Kong." In a statement released later, Didi said the board has authorized the move and that it will "hold a shareholders' meeting at an appropriate time in the future to vote on the matter." "The company will ensure that shares traded in the US can be converted at the option of shareholders into company shares on another internationally recognized stock exchange."

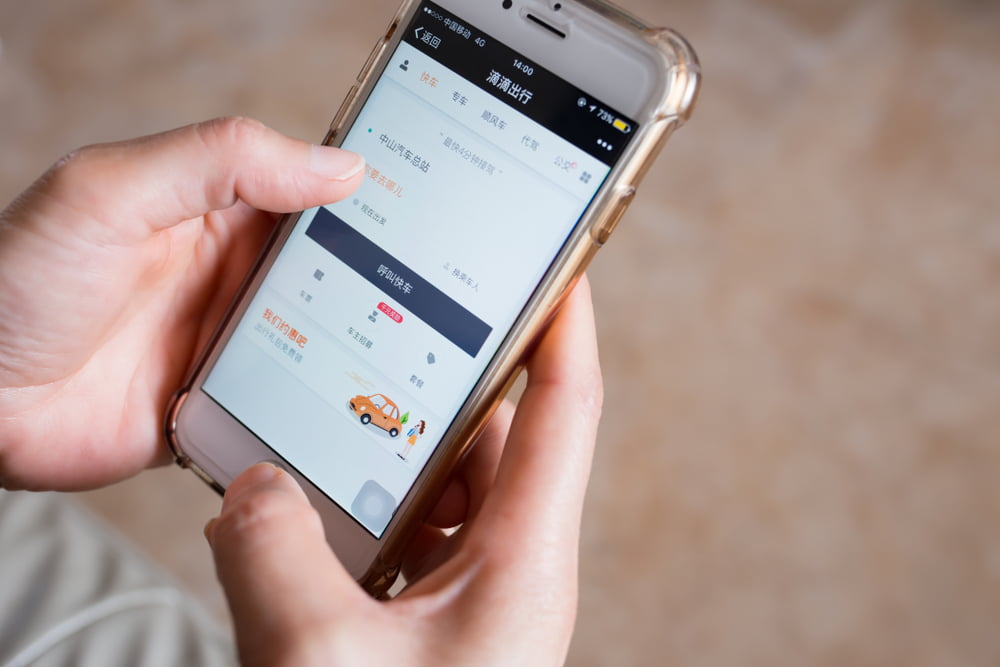

Didi, which controls 90% of the taxi market in China, has only been on Wall Street since this summer. It was leaked last week that the Chinese Cyberspace regulator (CAC) would have asked Didi to come up with a plan to leave the stock market. The regulator is afraid that sensitive data could end up in foreign hands and had therefore asked the tech company to postpone its IPO pending a security screening.

According to Reuters news agency, Didi is said to be preparing to relaunch his apps by the end of the year as Beijing's cybersecurity investigation is believed to have been completed by then. Didi's share stood at $7,8 on Friday, almost half of the price at which the company started. Shares in Didi investor SoftBank Group Corp. fell more than 2% after the news. SoftBank owns 21,5% of Didi's shares, followed by Uber which has 12,8%.

Read complete article

Also read: Taxi service Didi may have to give up stock exchange listing