People often also use their company car or bicycle privately. They have to pay tax on those private kilometers. This is clear for a company car, because the Tax and Customs Administration adds a fixed amount to the salary and about it tax has. But for a bicycle, people had to keep track of exactly how many miles they travel for work and how many in their free time. They then had to deduct maintenance and insurance costs for the lease bike.

that resulted in a lot of calculations and hassle

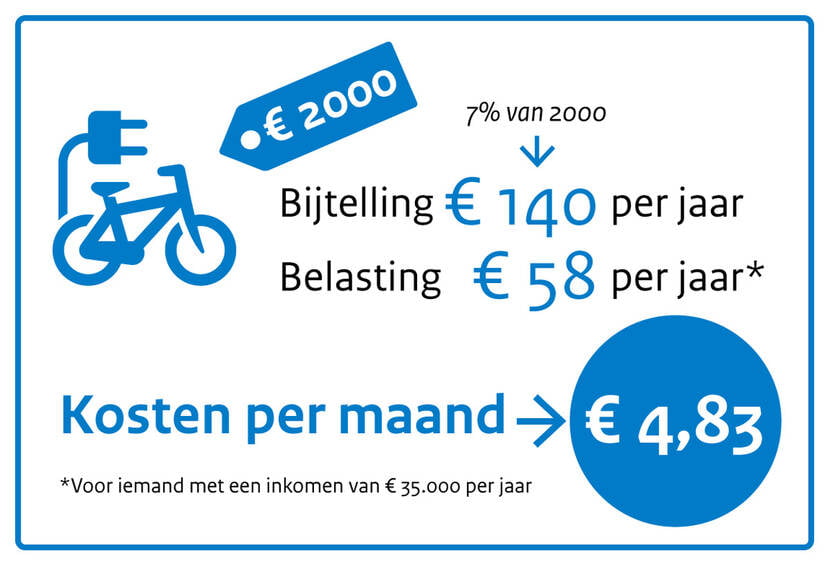

Anyone who leases a bicycle will be relieved from 2020 of the complex accounting associated with it up to and including 2019. For example, the cabinet hopes to get more commuters on their bikes. From 2020, the flat-rate addition for the private use of a business bicycle has been set at 7 percent of the value (including VAT). As a result, an average lease bicycle only costs the employee a few euros per month.

The lease bicycle remains the property of the company, just like a lease car. There is no maximum value for a lease bicycle. So expensive e-bikes and speed pedelecs are also eligible for this scheme. The percentage for a lease bicycle is part of a simplification of the tax bicycle scheme, which is included in the 2019 Tax Plan. The House of Representatives has already agreed to this, and the scheme will enter into force from January 2020.

Does the employee use a company bicycle? Then he or she may no longer receive certain travel allowances from the employer. For example a mileage allowance. On the other hand, the employee also incurs less or no travel costs. The employer determines which travel costs will be reimbursed or not.

The employer may also choose to pay the addition. This can be done by using the free space in the labor costs scheme. In that case, the employee does not have to pay tax at all.

Also read: We will soon stumble across unused shared bicycles everywhere